Surviving America While Black is a 4 step process

1. You are invited to apply to become a member of one of our Series Investment Clubs (SICs) and you make a capital contribution of at least $120/year or $10/month.

Since this will be a “Closed Private Crowdfunding Network: CPCN“, you must be invited to apply to join by a person with whom you have a “substantive, pre-existing relationship”. If your application is approved, you will be required to make the minimum annual investment contribution of $120/year or $10/month. You will be required to view three (3) educational modules before you are allowed access to our Investment Opportunities system.

Each SIC has the choice to participate in any (or all) of the Investment Opportunities that the Parent Investment Club (PIC) invests in. If it does, then its individual members get the opportunity to earn a preferred return on investment (ROI) of at least 25% on EVERY real estate investment deal over a 3-6-month period (our lawyers say we can’t say guarantee, as there’s a risk in every investment).

Each SIC can invest up to $5 million before being classified as an investment company (rather than an investment club) and subject to the overview of the SEC.

2. Investment Club members receive capital gains distributions for each Investment Opportunity that you and your SIC choose to participate in.

The timing of the capital gains distribution is based on the length of time of the investment. For the “flip” real estate Investment Opportunities, the length of time of the investment is the length of time to rehab or replace the building (home) on the property (usually 3-6 months). Once a property is rehabbed/replaced, it is sold within 90 days through our proprietary “closed sales system”, automatically generating at least a 25% cash on cash preferred return on investment (ROI) profit on EVERY flip real estate deal (again, our lawyers say we can’t say that we guarantee a specific profit amount, but our system generates at least a 25% profit, or else we don’t do the deal).

3. We recommend that you reinvest your money and grow it until you reach your Financial Independence Number, then roll your money over into a Qualified Opportunity Fund (QOF).

Through our Knowledge Center, we teach you what is Financial Independence, what is your Financial Independence Number (FIN), and how to develop a plan to get there. We’ll also teach you the financial principles of compound interest, leverage, how to manage and shift risk, and the difference between appreciating assets (short term buy low, sell high) and cash flowing assets (long term buy and hold).

4. Invest in a QOF for at least 10 years, and when you sell your investment all appreciated value will be 100% TAX FREE (no federal income, capital gains, or ATM tax)!

If you invested $10,000 of capital gains into a QOF in 2022 and in 2033 you sell it and it’s worth $50,000, you won’t pay any federal taxes on the $40,000 in profit.

Click the infographic below to enlarge

How do we create Capital Gains?

Flipping houses

We will invest mostly in short-term appreciating assets that can be purchased and sold usually within 90-180 days. This will mainly be done by purchasing distressed properties in traditionally Black neighborhoods in Detroit, fixing them up (rehabilitation) or replacing them, and then selling them using our proprietary “closed sales system”. Our system generates a preferred return on investment (ROI) of at least a 25% on EVERY deal.

How we choose properties

We are using a proprietary “closed sales system” that identifies appropriate properties, then manages and shifts risks while using leverage to generate projected above average double digit returns on every deal: The Real Estate Deal Management System (REDMS).

We take the guess work out of it: Deal or No Deal

Once we identify a property in the selected investment area, we enter in the purchase price, after repair value (how much we can sell it for to someone who wants to own it), the rehab/replacement costs and time, and the average market rent. The REDMS tells us “Deal” or “No Deal“.

Once we purchase a property, The REDMS also manages the rehab/replacement project to incentivize the General Contractor for completing the rehab project under budget and/or ahead of schedule, as well as penalizing the General Contractor for going over budget or past the scheduled deadline.

Guaranteed sold every time!

The REDMS also has a unique method for guaranteeing that every house is sold at a predetermined price (contingent purchase agreements).

Upon sale of the property, we will recoup our investment plus a preferred return on investment (ROI) of at least 25% of the cash invested. That profit is considered short-term capital gains, which are distributed on a per deal basis.

Long Term Capital Investment: LTCI

The rehabilitated/replaced homes may be sold to unaffiliated 3rd parties who turn the “fix and flips” into “Turnkey buy and hold” properties to be owned by Long Term Capital Investment (LTCI) companies, such as QOFs, that generate monthly income, as well as long term (10 years) appreciation.

The Qualified Opportunity Funds to Rebuild Detroit (QOF)

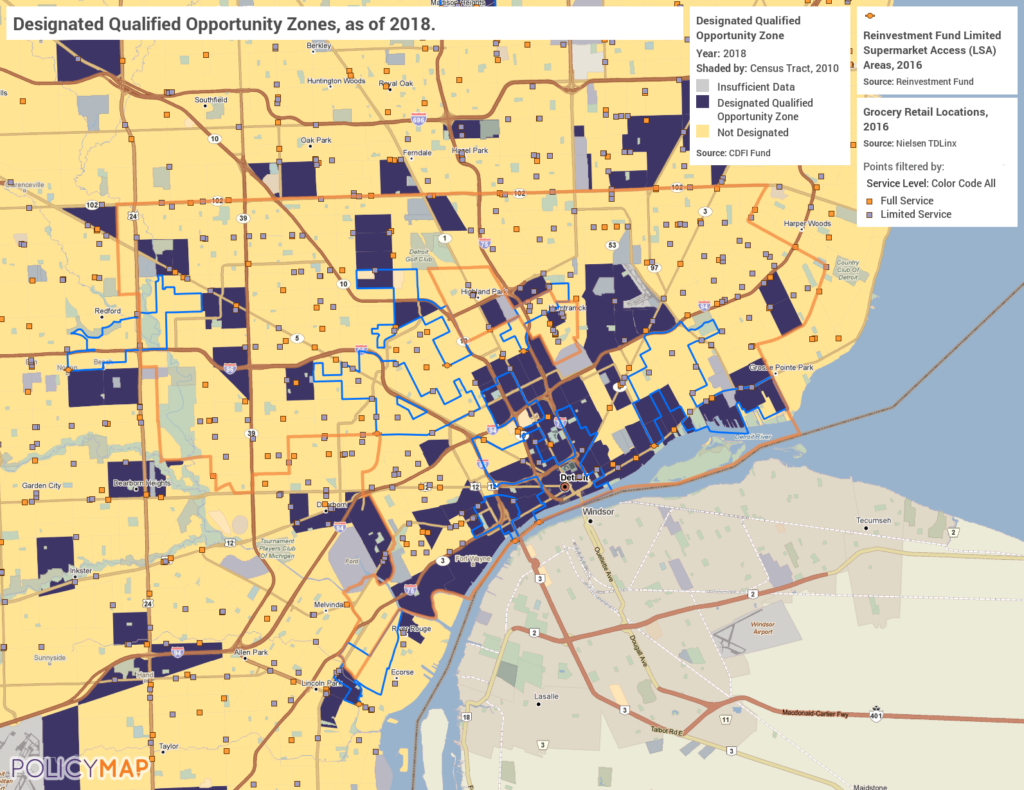

How does the QOF make money and build Black wealth? The QOF must invest at least 90% of its funds in Qualified Opportunity Zones (there are more than 70 in Detroit, see the map), either by purchasing real estate, or investing in businesses in Qualified Opportunity Zones. We will do both.

We will use the QOF and LTCI companies to strategically purchase real estate and invest in Black businesses to ultimately create self-sufficient, self-reliant, and self-determinant private, gated, Black-owned and controlled Master Planned Communities that provide food, clothing, housing, jobs, security and the educational, health and social support systems necessary for the Black community to survive America.

- 1. The Presentation: Supporting the Black Community to Survive America

- 2. The Plan: Using Investment Clubs with QOFs to Rebuild the Black Communities

*The BNIC4RBD is now The BNIC Network